On the night of January 21 (GMT+1), Guangzhou Night, organized by Cedar Holdings, made its debut in the World Economic Forum (WEF) Annual Meeting for the very first time. Through a variety of Cantonese culture showcases and city promotion activities, Guangzhou Night gave the world a glimpse of the new vitality of Guangzhou in the globalization.

In Guangzhou Night during the 2020 WEF Annual Meeting, Cedar Holdings signed a SPA with Stemcor, an international steel and raw material trader. The SPA sees Cedar Holdings purchase 100% share capital of Stemcor. Once announced, this purchase became a focus of attention in the relevant sectors. Reports from the global media outlets including New York Times, Bloomberg, Reuters and FT, Xinhua News Agency, Cankaoxiaoxi came out rapidly.

Focus of the international media

Cedar Holdings bought out Stemcor, a leading steel trader

From leading news organizations including Reuters, New York Times, Bloomberg and FT:

On the night of 21 January (GMT+1), a SPA was signed that sees Cedar Holdings Group Co., Ltd. ("Cedar Holdings") from China purchase the entire share capital of Stemcor Global Holdings Limited ("Stemcor"). This is the latest attempt of Chinese companies to enter the UK steel industry.

Stemcor, a UK based company, was a Top 3 global independent steel trading company. With business operations covering 30 countries and regions, Stemcor helps customers choose from over 3,500 different grades of steel and raw materials available in the market. Stemcor enjoys a 30-year history in China as both a purchaser and seller of steel and steel-making raw materials.

Cedar Holdings, headquartered in Guangzhou, China, is a leading participant in the commodities sector of China. Also known as "the Chinese equivalent of Glencore", Cedar Holdings is actively increasing its footprints globally, improving its international influence. Cedar Holdings ranked 301st on the 2019 Fortune Global 500 with $40.6 billion in total revenue.

Cedar Holdings is dedicated to building a world-leading commodities group. Stemcor has a well-established global sales network, which will present potential synergy with the existing domestic and international business of Cedar Holdings. At the same time, supported by Cedar Holdings, Stemcor will be able to develop new business opportunities. The transaction is a win-win result where complimentary benefits will emerge.

Reuters and The New York Times

Bloomberg:

Chinese Conglomerate Cedar Buys U.K Steel Trader Stemcor

China's Cedar Holdings Group Co. agreed to buy Britain's Stemcor Holdings Group capping a decade of upheaval for the 68-year-old steel trader.

"The merger will enhance our globalization strategy on non-ferrous metals, and bring development opportunities to Stemcor,"Han Gang, vice president of Cedar, said in an interview from Davos, Switzerland, where the transaction was signed.

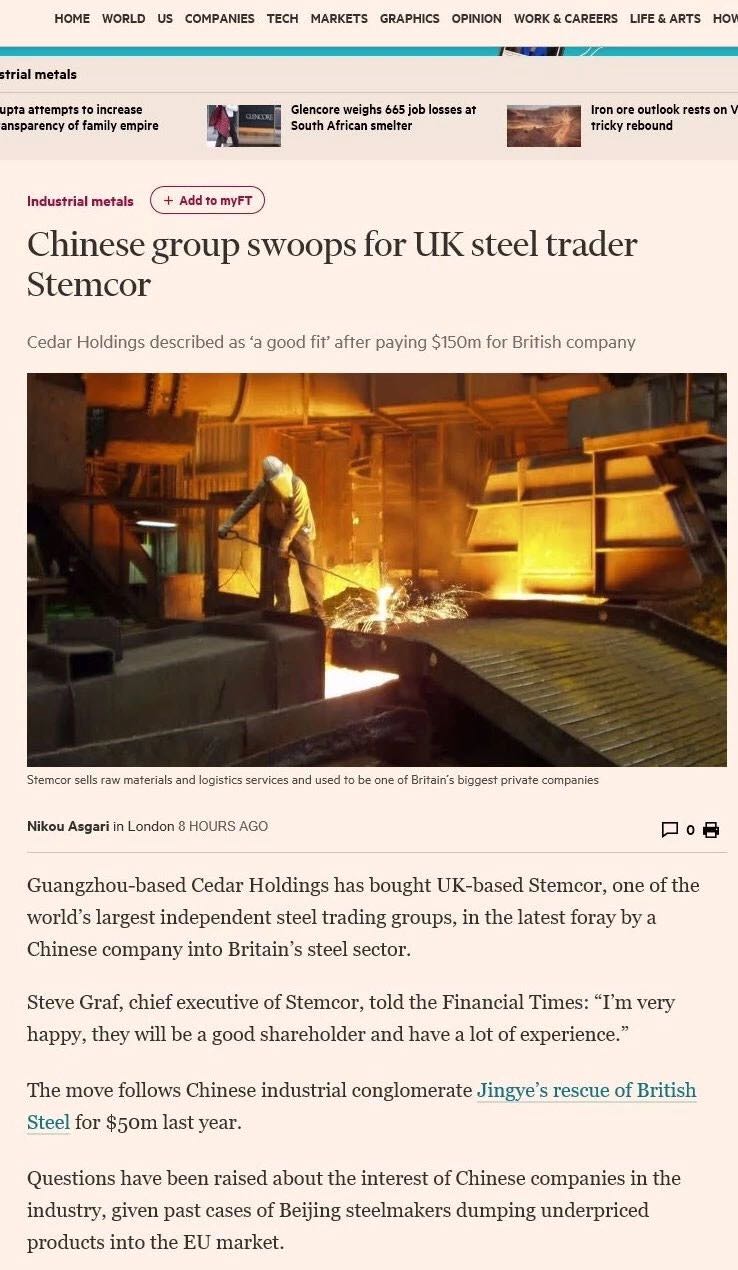

Financial Times:

Chinese group swoops for UK steel trader Stemcor

Guangzhou-based Cedar Holdings has bought UK-based Stemcor, one of the world’s largest independent steel trading groups, in the latest foray by a Chinese company into Britain’s steel sector.

Steve Graf, chief executive of Stemcor, told the Financial Times:"I'm very happy,they will be a good shareholder and have a lot of experience."

Focus of the Chinese media

Chinese commodities company expanded its overseas footprints even faster

From big Chinese news organization including Xinhua News Agency, Xinhua Finance, Cankaoxiaoxi, Economic Information Daily and Guangzhou Daily:

With increasing uncertainties of the world economy and risks of broken supply chains worldwide, Cedar Holdings' acquisition this time represents Chinese companies going global to fight for a bigger say in the commodities sector.

China is a large consumer of commodities while it suffers from shortages of raw materials needed in many sectors due to the world uneven resources distribution. It is a necessity for Chinese commodities supply chain companies to go global when their development reaches a certain stage.

Stemcor's well-established global sales network is exactly what Cedar needs to accelerate its "go global strategy" implementation and overseas market expansion in order to achieve its full coverage of the commodities industrial chain.

Xinhua Finance:

"To build a world-leading commodities group", said King Cheung in its interview during the WEF

King Cheung, Chairman of the Board of Cedar Holdings told the reporters that acquiring Stemcor is key to Cedar's business development. This will improve Cedar's international supply chain and sales network, accelerating its globalization drive. At the same time, this purchase would present great synergy potential, enriching Cedar's ferrous metal industrial chain and the categories of its products.

Xinhua News:

Cedar Holdings bought out Stemcor, a giant steel trader

Cedar Holdings is a leading commodities company in China with business operation mainly in non-ferrous metal and chemicals. Ferrous metal industrial chain takes a small share of its business. The acquisition of Stemcor will help Cedar Holdings get access to larger international sales networks and and better allocate its assets overseas.

Not a Chinese company could be found among the world's five largest commodities supply chain companies. Compared to their counterparts in Asia, Chinese companies still have a long way to go

Xinhua Silk Road

China's Cedar Holdings buys out UK's Stemcor

DAVOS, Switzerland, Jan. 23 (Xinhua) -- China's leading supplier of bulk commodities Cedar Holdings Group Co Ltd ("Cedar Holdings") signed an agreement with the UK-based Stemcor Global Holdings Limited ("Stemcor") on acquring 100 percent equities of the latter on Tuesday .

Cedar Holdings, headquartered in Guangzhou, capital of south China's Guangdong Province, is known as "the Chinese equivalent of Glencore".It is actively expanding its global presence.

Founded in 1951, Stemcor, a UK-based company, was a Top 3 global independent steel trading company. With business operations covering 30 countries and regions, Stemcor helps customers choose from over 3,500 different grades of steel and raw materials available in the market. Stemcor enjoys a 30-year history in China as both a purchaser and seller of steel andsteel-making raw materials.

Cankaoxiaoxi

Speed up going global ! Cedar Holdings bought out Stemcor, a giant steel trader

Through this acquisition, Cedar Holdings will be able to have experienced global sales team, upstream and downstream channels as well as a huge client base with long-lasting relationships, strengthening its competitive advantage in the commodities sector. When the deal is completed, Cedar will benefit from Stemcor's global sale network, which will present potential synergy with the existing domestic and international business of Cedar Holdings. At the same time, supported by Cedar Holdings, Stemcor will be able to develop new business opportunities. The transaction is a win-win result where complimentary benefits will emerge.

This deal took place against the backdrop of the increasing sourcing activities of Cedar Holdings in recent years. Zijin Mining, one of its key partners, completed the purchase of Timok copper-gold mine (upper belt ore) last month.

Economic Information Daily

Cedar Holdings bought out Stemcor in an effort to help the steel exports recovery of China

2019 saw a high supply and demand in China steel industry while steel exports shrank further to 64.293 million tonnes, almost half of 112 million tonnes in the peak time of 2015. According to the estimates of China Iron and Steel Industry Association, the supply will exceed demand in the 2020 Chinese steel market. Under the circumstances, companies such as Cedar Holdings could help the recovery of the China steel exports and tackle the overcapacity in 2020 through making full use of well-established international sales networks.

As more and more Chinese commodities companies expand their business presence overseas, increase their access to upstream resources and supply chain networks, China stands a great chance of winning a bigger say and bargaining power in the global commodities market.

Guangzhou Daily

Cedar Holdings bought out Stemcor for new growth of the ferrous metal business

" By drawing on Stemor's resources and sales networks, Cedar Holdings could enrich its ferrous metal industrial chain." said a ferrous metal analyst from a large futures company based in South China. Specifically, based on Stemcor's cooperation with leading steel companies from China and beyond as well as the existing client base of Cedar Holdings, Cedar Holdings will be able to rapidly gain an edge in some high quality special steel trade.

"When the purchase is completed, Cedar Holdings is expected to do well in both domestic and foreign steel trade, reinforce its steel supply chain at home and aboard and create new growth of ferrous metal." The analyst added that the bargaining power of Cedar Holdings in particular would see leaps and bounds, which mean it is easy for the company to obtain discounts on steel plant and minerals and a bigger say in pricing ferrous metals in the world.

Besides, the acquisition will offer potential synergies with the existing businesses of Cedar Holdings including supply chain finance, new materials and advanced manufacturing.